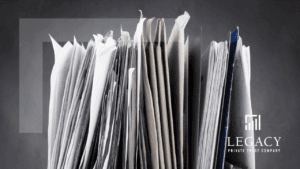

Your Family Needs to Know How to Access Your Estate Planning Documents

Making sure your family will be able to locate your estate planning documents when needed is one of the most important parts of the estate planning process. Your carefully prepared will, trust or power of attorney will be useless if no one knows where to find it.