In an age where technological innovation and digital connectivity continually intersect, the financial sector stands on the precipice of a game-changing transformation. A crucial part of this profound revolution is the burgeoning Internet of Things (IoT), a term that is fast becoming a mainstay in the technology and banking dialogue.

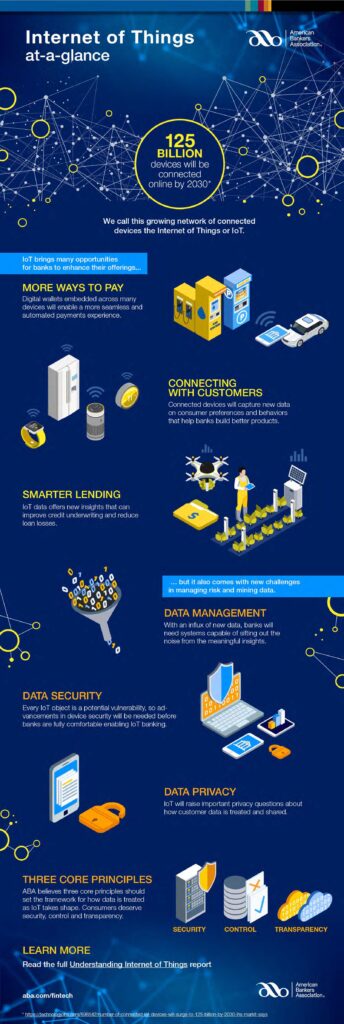

The Internet of Things, or simply IoT, signifies an expanding network of devices, appliances, and systems linked via the Internet. As projected by experts, a staggering 125 billion devices will be interconnected through the Internet of Things by 2030. This massive leap in connectivity will inevitably shape numerous sectors and banking is no exception.

As a frontrunner in the financial services industry, Legacy Private Trust Company understands the importance of demystifying the Internet of Things and its potential impact on banking. We believe it’s essential to keep our clients informed, involved, and prepared for the future shaped by IoT.

The Internet of Things: A New Dimension to Fintech

The IoT isn’t just about amplifying connectivity—it promises numerous opportunities for banks to diversify and enrich their service offerings while fostering a deeper, more personalized relationship with their customers.

However, navigating the vast ocean of the Internet of Things is full of challenges. As IoT grows, so do the complexities, particularly concerning risk management and data mining, which demand careful attention.

IoT and the Future of Payments

One of the exciting prospects the Internet of Things brings to the banking sector is the transformation of the payments landscape. With digital wallets integrated across many devices, IoT promises a more seamless, automated transaction experience. This shift is set to offer customers unprecedented convenience, enhancing their overall banking experience significantly.

Leveraging IoT for Customer Insights

The Internet of Things stands to be a treasure trove of valuable data. Banks can glean unique insights as IoT devices continually gather and share information on customer behavior and preferences. These insights can be the key to crafting more personalized products and services, accurately reflecting customer needs and expectations.

IoT and Lending: A Match with Potential

The Internet of Things data can be a potent tool in the lending sphere. IoT can enhance credit underwriting procedures by offering a fresh perspective on customer financial behavior, reducing loan losses considerably. This improvement benefits the banking institutions and the customers, making the lending process more efficient and customer-friendly.

Managing the Data Deluge from IoT

However, the influx of data from the Internet of Things can be as overwhelming as it is insightful. Efficient data management systems will be necessary to sift valuable insights from the noise. Banks will need to invest in robust and sophisticated systems capable of handling, interpreting, and utilizing the data deluge from IoT.

IoT, Security, and Privacy

The rise of the Internet of Things also amplifies potential security risks. Each IoT device represents a possible point of vulnerability. Hence, enhancements in device security must keep pace with IoT’s growth to allow banks to harness IoT data confidently.

In addition, the abundance of personal data that IoT devices will generate brings up substantial privacy concerns. Addressing these concerns comprehensively will be essential before banks can leverage the full potential of the Internet of Things data.

Core Principles for Navigating the IoT Era

In light of these changes brought about by the Internet of Things, there are three core principles for customer data treatment and sharing:

- Security: Ensuring robust safeguards to protect data from breaches or misuse.

- Control: Customers should have definitive control over their data and how it’s used.

- Transparency: Institutions must maintain absolute clarity about their data practices.

Upholding these principles will be increasingly critical to maintaining a healthy financial ecosystem as the Internet of Things evolves.

As we look towards a future defined by the Internet of Things, Legacy Private Trust Company remains steadfast in embracing this evolution, upholding the highest standards of security, control, and transparency. We are committed to our role as navigators, guiding our clients through this exciting era of the Internet of Things in banking. Join us on this journey to the future.

To see the Internet of Things at a glance, take a look at the infographic below. For even more, in-depth information, visit the American Bankers Association’s website and read their report on Understanding the Internet of Things.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.