National Get Smart About Credit Day serves as a timely reminder about the significance of safeguarding our personal and financial information. While the primary focus of the day revolves around credit awareness, another financial threat casts a shadow on young adults—student employment scams.

Disturbing Trends: The Numbers Speak

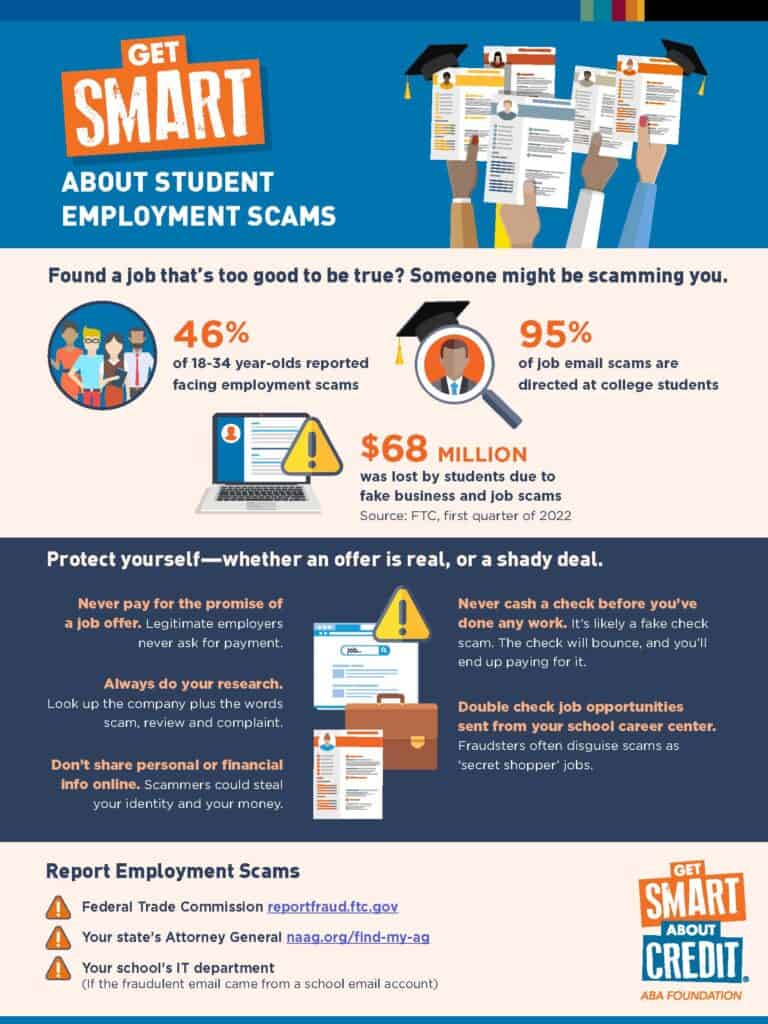

Recent data released by the Federal Trade Commission (FTC) offers a grim perspective on the growing issue of employment scams:

- A concerning 46% of individuals between the ages of 18-34 reported facing employment scams.

- A whopping 95% of job-related email scams target college students.

- Students have been duped out of an alarming $68 million due to deceptive business and job scams.

These aren’t just statistics; they represent real people and real losses. Moreover, falling victim to such scams doesn’t just lead to a temporary financial setback. Many affected students find themselves embroiled in a cycle of debt, impacting their credit scores and potentially their long-term financial trajectories.

Staying Ahead of Employment Scams: Protective Measures

Awareness and proactive action are your best defense against the predatory practices of employment scams. Here’s how you can fortify your defenses:

- Recognizing Red Flags: When navigating the job market, it’s crucial to stay vigilant. If a potential employer ever asks for an upfront payment as a condition of a job offer, this should set off alarm bells. Such demands are often indicative of deceptive practices. It’s a fundamental principle to remember: genuine employers, whether big corporations or small businesses, will never charge you to join their team.

- The Power of Research: Before enthusiastically agreeing to any job offer, take a step back and invest some time in research. A simple online search combining the company’s name with keywords like “scam,” “review,” and “complaint” can provide a wealth of insights about the company’s reputation. It’s a small step that can potentially save you from major pitfalls.

- Personal Information is Precious: Living in a digital era comes with its set of challenges. Among them is the protection of your personal and financial details. Scammers view this information as a goldmine. Thus, it’s paramount to be extremely judicious about where and with whom you share your details online. Once lost, regaining your privacy can be a complicated affair.

- Checks and Imbalances: Picture this – you’re offered a job, and even before you start, you receive a check. While this might seem like a dream scenario, it’s often a nightmare in disguise. Such premature payments are hallmark signs of fake check scams. When the check bounces—as it almost certainly will—you’ll be the one facing the financial repercussions.

- Trust But Verify: Trust is a valuable commodity, but in professional dealings, verification is equally essential. If a promising job opportunity comes your way via official-looking channels, such as your university’s career center, it’s still advisable to scrutinize its legitimacy. Scammers are increasingly sophisticated, sometimes using familiar platforms to make their offers seem more credible.

Reporting: Your Role in the Bigger Picture

If you find yourself ensnared by or suspecting employment scams, it’s imperative to sound the alarm:

- Federal Trade Commission: reportfraud.ftc.gov

- State’s Attorney General: Locate your state’s representative at naag.org/find-my-ag.

- Your Educational Institution: Scammers don’t shy away from using school email accounts. If you spot a suspicious email, immediately alert your school’s IT department.

A Call to Vigilance

National Get Smart About Credit Day isn’t just about credit awareness but financial literacy and safety in all aspects. By staying informed and vigilant, students can shield themselves from the perils of employment scams and embark on a path of secure financial futures.

Legacy Private Trust Company is steadfast in its commitment to the financial well-being of our community. Through continuous education and resource-sharing, we empower individuals to navigate their financial journeys confidently.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or info@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.