May is National Elder Law Month, a time to raise awareness and educate ourselves about the critical issues affecting our senior population. Elder financial abuse is one of these pressing concerns, especially in a world where financial transactions have become increasingly complex and varied. The impact of financial elder abuse on our seniors is significant, often leading to devastating financial and emotional consequences. At Legacy Private Trust Company, we are dedicated to safeguarding the financial well-being of seniors. Recognizing and understanding the patterns that indicate potential financial exploitation is a significant step in this direction.

Defining Financial Elder Abuse

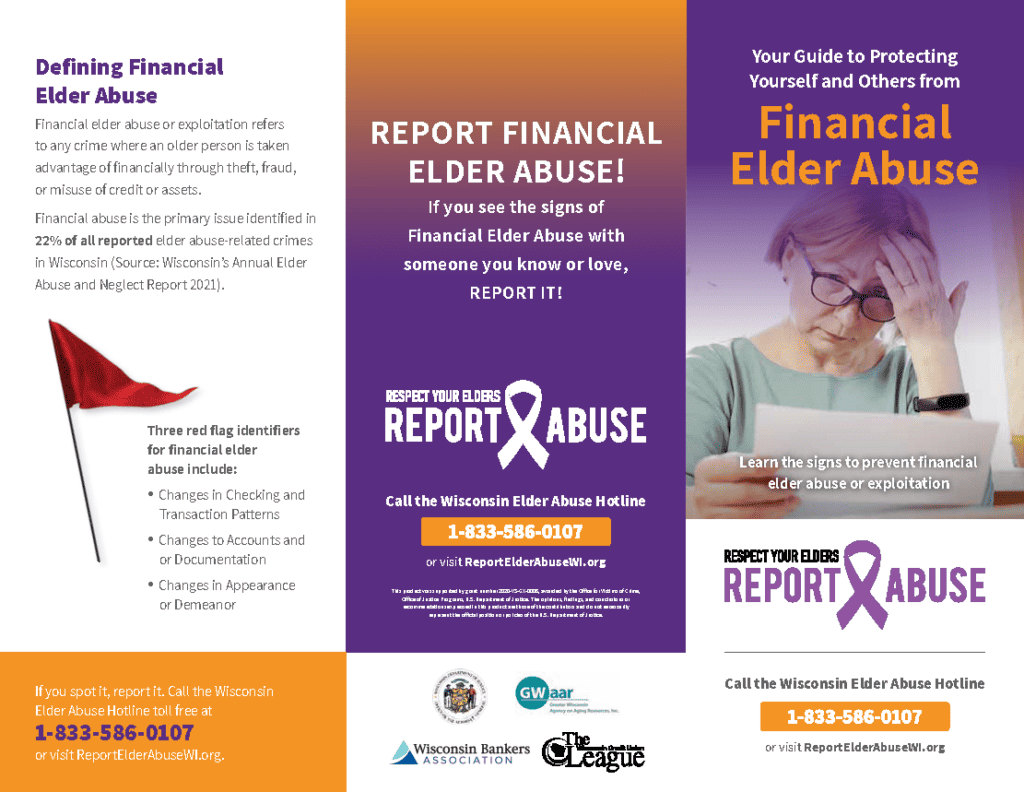

Financial elder abuse encompasses a range of illegal or improper actions, including theft, fraud, and misuse of an elder’s credit or assets. For instance, in Wisconsin, 22% of all reported elder abuse-related crimes in 2021 were linked to financial abuse (Source: Wisconsin’s Annual Elder Abuse and Neglect Report 2021). Identifying red flags in checking and transaction patterns, account changes, and behavioral shifts is crucial in combating this issue.

Identifying Abnormal Checking and Transaction Patterns

Noticeable changes in checking and transaction patterns are the first red flags in potential elder financial abuse. Regular monitoring of financial activities can aid in the early detection of unusual occurrences. Signs such as “out-of-sync” check numbers, frequent bounced checks and overdraft fees, uncharacteristically large withdrawals, increased account activity, and the mysterious disappearance of funds or assets indicate possible financial fraud. Staying vigilant and recognizing these warning signs is essential, as they can often be subtle yet indicate more significant issues.

The Role of Third-Party Transactions and Caregiver Payments

Transactions made to third parties or caregivers are another area of concern. Elder caregivers may be overcompensated or paid more frequently than necessary. Unfortunately, family members and caregivers, often those closest to the senior, are frequently the perpetrators of this type of financial abuse. Observing the flow of money towards these third parties is critical. Large transfers or irregular payment patterns to caregivers should raise an immediate red flag and warrant further investigation.

Account Changes and Documentation Alterations

Changes in account details or documentation without the elder’s knowledge can be significant indicators of financial elder abuse. Monitoring for unauthorized transfers of assets, particularly real estate, or forging the senior’s signature on financial documents or titles is crucial. Keeping an eye on changes or additions of authorized signers on bank accounts or alterations in the institution’s signature cards can help prevent financial abuse.

Behavioral and Physical Changes as Indicators

Financial abuse often manifests in physical and behavioral changes in older adults. Significant shifts in appearance or demeanor can be telling signs. If a senior appears disheveled, forgetful or confused more often than not, it could indicate underlying issues, including financial exploitation. Be cautious if the elder is accompanied by a companion who appears overly controlling or involved in their financial decisions. Scenarios where the senior is overly excited about winning sweepstakes or lotteries or divulging financial information to unknown people or agencies are also red flags.

Comprehensive Financial Elder Abuse Prevention

Ensuring the financial security of elderly clients involves addressing several critical areas of concern. Firstly, client well-being is paramount, requiring careful management of their assets to provide long-term financial stability. Legal compliance is also vital, as navigating the complex landscape of elder law regulations is essential to protect clients and their interests. Estate planning plays a significant role, with strategies including wills, trusts, and power of attorney arrangements being crucial for effective asset management and transfer. Planning for healthcare and long-term care expenses is another primary concern, as these costs can significantly impact an elder’s financial situation. Preventing elder abuse involves recognizing and stopping financial exploitation, which often requires vigilance and proactive measures. Understanding Medicaid eligibility and planning is vital for clients needing assistance, ensuring they receive the support they need without depleting their assets. Finally, managing family dynamics is essential, particularly regarding inheritance disputes and care decisions, to ensure that the elder’s wishes are respected and upheld.

For financial professionals interested in elder law, focusing on several key points can enhance their ability to serve elderly clients effectively. Here are the crucial areas to consider:

- Guardianship and Conservatorship: Understand the responsibilities and implications, as they significantly impact financial planning.

- Trusts and Estates: Learn about the benefits and types of trusts available for protecting and managing assets.

- Long-Term Care Insurance: Evaluate and advise on options to help clients prepare for potential future needs.

- Social Security and Medicare: Maximize benefits while understanding coverage limitations for comprehensive financial planning.

- Legal Instruments: Gain a thorough understanding of Power of Attorney, Living Wills, Health Care Proxies, and Advance Directives to ensure clients’ healthcare and end-of-life wishes are respected.

- Tax Implications: Understand the tax consequences of various elder law strategies and tools to make informed decisions.

- Financial Scams: Recognize and protect clients from common scams targeting the elderly to ensure their financial security.

Commonly asked questions in this field often revolve around the differences between a will and trust and determining which suits a client’s needs more. Financial professionals frequently seek guidance on helping clients qualify for Medicaid without exhausting their assets. Steps to take if financial abuse is suspected are also a significant concern, highlighting the need for vigilance and appropriate actions. Understanding how guardianship and conservatorship impact financial planning is another common inquiry, as these roles carry substantial responsibilities and implications. Questions about the tax implications of transferring assets to children or setting up a trust are also prevalent, underscoring the importance of informed tax planning. Protecting clients’ assets from long-term care costs is a frequent topic, as is understanding the benefits and drawbacks of long-term care insurance. Lastly, ensuring that clients’ healthcare and end-of-life wishes are respected involves thorough knowledge of relevant legal instruments and directives.

By addressing these concerns, points of interest, and commonly asked questions, financial professionals can better serve their elderly clients and effectively navigate the complexities of elder law. This comprehensive approach protects seniors’ financial well-being and provides peace of mind for their families.

Taking Action: Reporting Financial Elder Abuse

If you observe any warning signs of financial elder abuse, it is imperative to take action. Reporting suspected financial elder abuse can help protect the individual from further exploitation and bring the perpetrators to justice. In Wisconsin, concerned individuals can contact the Elder Abuse Hotline or ReportElderAbuseWI.org for guidance and support. Remember, you are not alone in this fight. At Legacy Private Trust Company, we stand ready to assist you in any way we can, providing the necessary resources and support to combat financial elder abuse.

At Legacy Private Trust Company, our commitment is to manage your assets efficiently and ensure our clients’ financial safety and well-being. Understanding and recognizing the signs of elder financial abuse is our responsibility. We can work together to create a safer financial environment for our seniors by staying informed and alert.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.