Investors should consider the limitations of ratio analysis in forecasting market returns

By just about any measure, stocks are not cheap by historical standards. Whether looking at price to earnings (P/E), Enterprise Value to Earnings Before Taxes, Depreciation and Amortization, or any other valuation metric, stocks appear to be expensive. Some may worry that it is time to get out of the stock market because of higher valuation; however, history has demonstrated that valuation is a poor timing tool.

Our Take

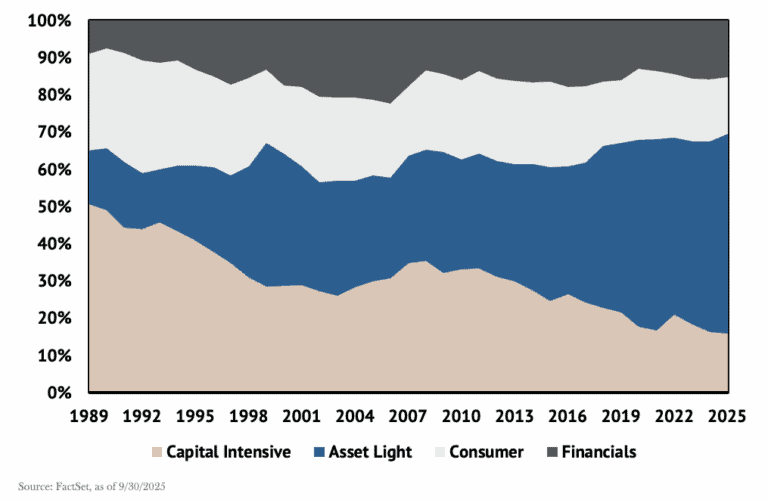

There are several possible justifications to consider before assuming stocks are priced to perfection. The S&P 500’s market composition has changed dramatically over the past several decades. Back in the 1980s and 1990s, capital-intensive manufacturing and consumer sectors made up the bulk of the index. Today, sectors such as technology and communication services dominate. These “asset-light” sectors tend to have lower fixed costs, such as labor, and higher margins, which typically translates to better earnings stability.

Chart Check: S&P 500 Composition Dynamic, More Conducive to Higher Valuations

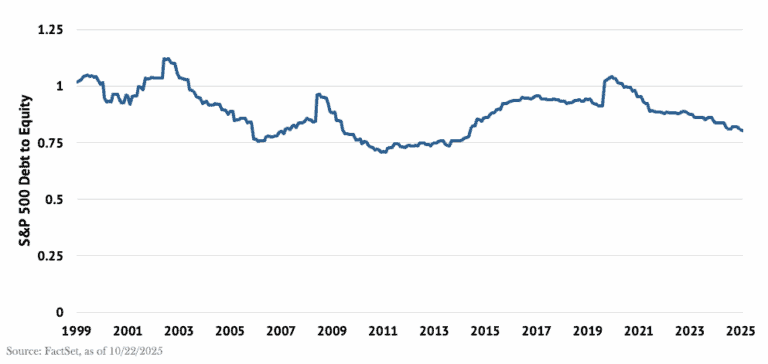

S&P 500 companies have much less leverage than in the past. Net debt/equity levels are roughly half of where they stood 30 years ago. In addition, the debt is of higher quality. In 2007, about 44% of S&P 500 debt was long-term and fixed. Today, that level is more than 80%. These efficiencies help explain why profit margins for S&P 500 companies have improved from roughly 7% in the early 2000s to about 12.5% today.

S&P 500 Debt to Equity Ratio Indicates Better Capital Structure

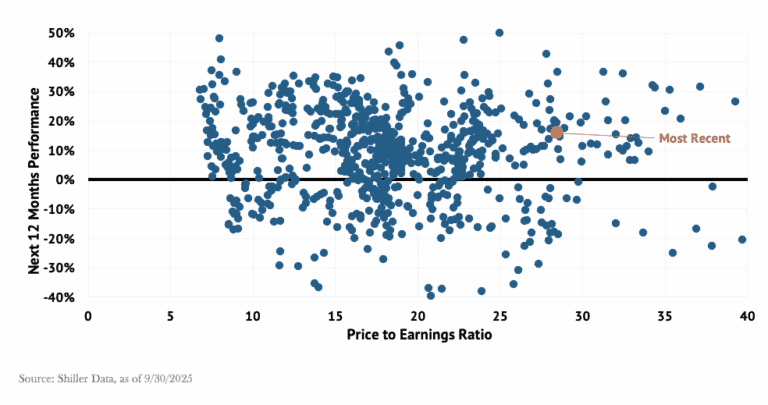

All this demonstrates why valuation is not the only factor to pay attention to when evaluating stock allocations. In fact, using historical data from Yale University’s Robert Shiller, we find little to no correlation between current valuation levels, as measured by Price to Earnings ratios, and subsequent 1-year S&P 500 returns, so history should probably not be your only guide when making investment decisions.

Valuation Far from Sole Equity Return Determinate

This monthly commentary is crafted by the Investment Officers at Legacy Private Trust Company and offers an in-depth look at current economic and market trends that impact your portfolio. Subscribe to get these insights, as well in-depth markesent directly to your inbox.

As an independent firm, our advice is always driven by what is in your best interest. Every decision we make is designed to support your long-term goals and financial well-being. As a client, you will gain access to experienced professionals who know your priorities and values. These experts serve as dedicated partners who recognize the complexities of family dynamics, personal ambitions, and the ever-changing market landscape.

If you are seeking clarity, strategy, and a trusted advisor to help you navigate what comes next—our team is here to help.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.