It is a time-honored adage that monetary policy affects the economy with long and variable lags. Well, that time is up if the tumult caused by the failure of a few regional banks is any indication. It’s important to remember that central bank rate changes impact the economy both directly and indirectly. The direct impact is obvious: Higher or lower interest rates cause immediate increases or decreases in borrowing costs to households and businesses, leading to corresponding changes in spending and investment. The impact of rising rates may be small or large, and the lags may be short or long depending on where the rate increases started from, how fast they increase, and how well-equipped households and businesses are to weather the increases as they occur.

The indirect effects are also obvious but usually not until they hit the headlines, which happens when the direct impact causes unintended consequences. While the Fed has direct control over short-term interest rates, its policies are also transmitted to the economy through their indirect effects on broader financial conditions. Generally, the two work in tandem; when the Fed raises rates to slow growth and tame inflation, that direct impact is reinforced by the indirect effects of tightening financial conditions. These include falling stock prices that damage wealth, wider yield spreads that punish lower-rated borrowers, and tighter lending standards at banks that restrict the availability of credit.

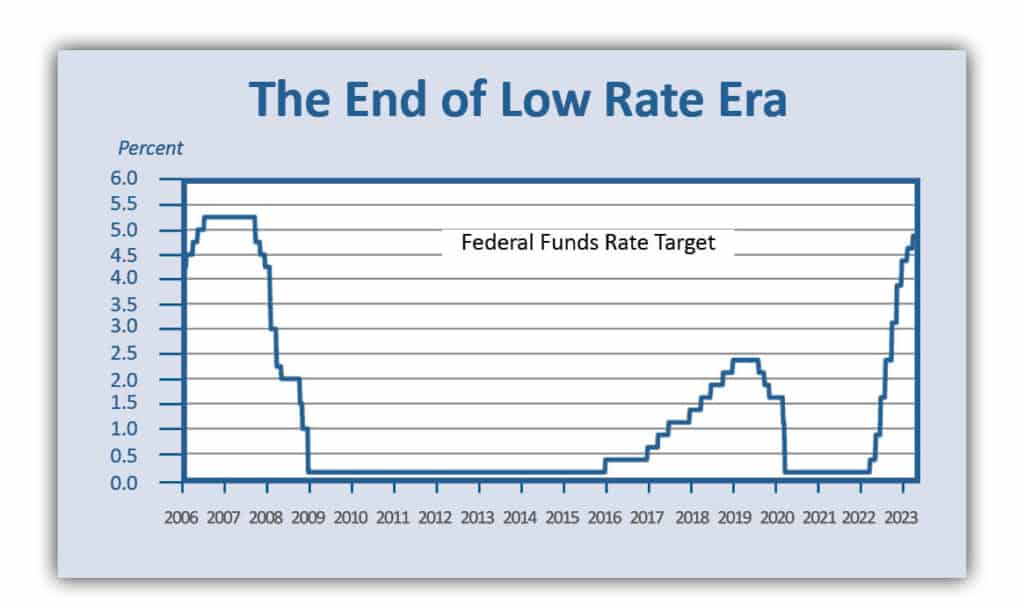

The Fed started raising rates a year ago. Until recently, the rate hikes had little direct effect on the economy, which continued to forge ahead at a healthy pace, and their indirect effects on the financial markets were barely noticeable. In hindsight, the muted response is not surprising. The Fed’s rate hiking campaign started from historically low levels – near zero – and faced powerful growth and inflationary tailwinds from enormous pandemic-era savings and robust job growth that fueled demand as well as lingering supply-chain constraints and labor shortages that fueled inflation.

Because the Fed waited too long to curb these forces, they needed to step on the monetary brakes harder and faster to get the response they desired. That frenetic race to catch up created unintended consequences that toppled the three regional banks, which were uniquely ill-equipped to handle the increases, and induced the financial turmoil that is still being sorted out. Happily, the swift response of policymakers to contain the damage by protecting depositors and providing sufficient liquidity to troubled banks appears to have worked, and the feared contagion that could undermine the financial system has been checked. But a lot of uncertainty remains, and recent events have clearly muddied the outlook for the economy and monetary policy.

The Fed’s Choice

In the weeks leading up to the Federal Reserve’s last policy meeting on March 21-22, it was widely expected that the Fed had a lot more work ahead of it to wrestle inflation, which is running around 6%, down to its 2% target. Many thought the Fed would need to raise its benchmark rate by a half-percentage point, faster than the quarter-point rise taken at the previous meeting in early February. But the banking stress that erupted in the days before the meeting put the kibosh on that prospect; the only remaining question was whether they would keep rates unchanged or nudge them up by another quarter-point.

The Fed chose the quarter-point increase, lifting the federal funds rate to a range of 4.75%-5.0%, marking the ninth increase in consecutive meetings totaling 4 ¾ percentage points. Fed chairman Powell also indicated that at least one more increase is likely, lifting the funds rate above 5% for the first time since 2007. Interestingly, Powell suggested that even more increases would be in the cards if not for the tightening of credit conditions sparked by the banking panic. In essence, the Fed leader is saying that the indirect effects of the Fed’s actions are having the same restrictive effect on the economy as would another quarter or half percentage point rate increase.

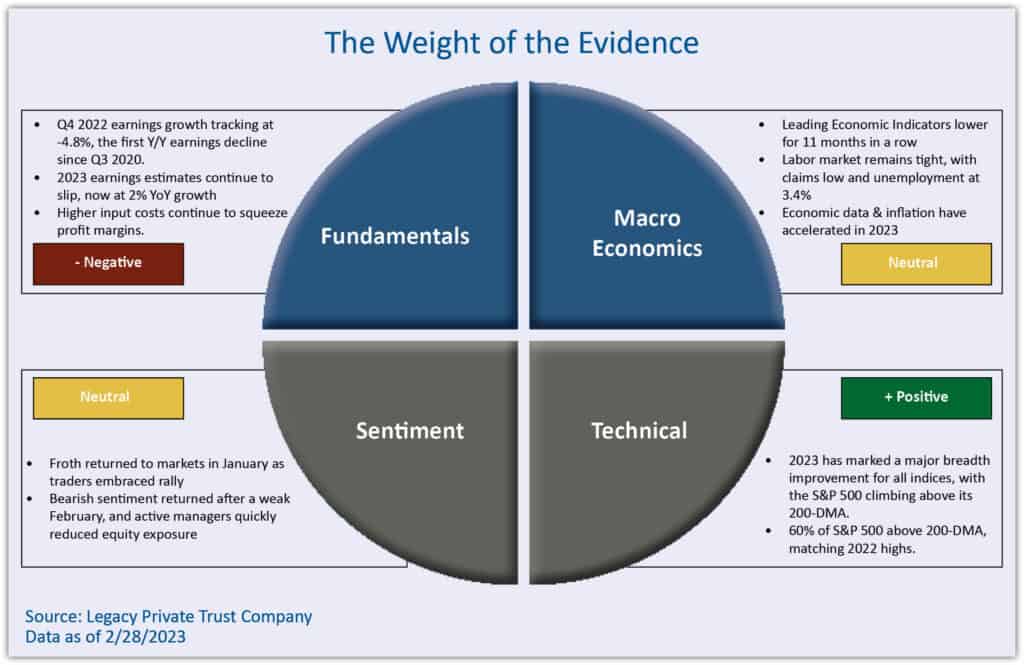

Critics of the move believe an increase was unwise as it risks amplifying stress on the banking system. In their eyes, that threatens to do more harm than the potential increase in inflation pressures that might occur by leaving rates unchanged. Time will tell, of course, but we believe the Fed made the right choice as it has the tools to both lower inflation and provide the necessary liquidity to ease stress on the banking system. Whether they hike again and leave rates at higher levels for the rest of the year, as they signaled at the policy meeting is another matter. The financial markets are nonbelievers, as traders are pricing in several rate cuts before the end of the year, convinced that the combination of higher rates and tighter credit conditions will usher in a recession over the second half of the year.

Hiking Until Something Breaks

No doubt, the Fed’s plan to keep raising rates heightens the risk that they will cause more serious damage to the economy and financial system than is acceptable. However, the Fed’s long-standing goal to restore price stability – defined as a 2% inflation rate – has so far been elusive. Some modest progress has been made, but it would be a mistake to think that inflation continues to recede on its own if the Fed moves to the sidelines. To drive a stake into the heart of inflation, something would have to break, either an abrupt downshift in the job market that weakens wage pressures and/or a marked falloff in consumer demand that reduces business pricing power.

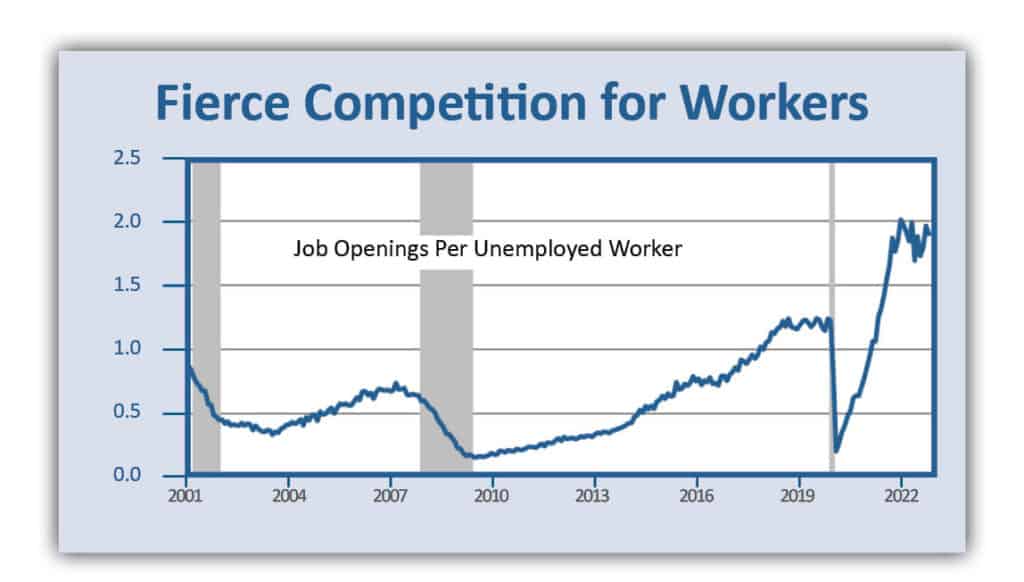

At most, the economy’s trajectory is bending but nothing of significance is breaking. Even the housing market that has been clobbered by surging home prices and mortgage rates is stabilizing, as sales have rebounded in recent months. But the more important spheres of influence are still going strong. The labor market remains historically tight, with unemployment at around 50-year lows and far more job openings than unemployed workers available to take positions. Wage increases are running at about 6%, which, assuming productivity growth of 1.5%, would need to slow to 3.5% to be consistent with a 2% inflation rate.

Meanwhile, businesses have not only been able to raise prices enough to cover rising labor costs. They also have, until recently, expanded profits in the process. However, that dynamic is changing, as a growing swath of households are running out of the excess savings accumulated during the pandemic and are resisting price hikes, prompting some pullback in spending. That has weakened business pricing power somewhat, contributing to the modest slowdown in inflation over the past several months. But instead of cutting labor costs, employers are holding on to workers and accepting narrower profit margins, hoping to avoid labor shortages when demand reaccelerates. True, many high-profile tech companies that have been hit hard by higher interest rates and a post-pandemic shift in spending habits have announced huge layoffs. But those workers are easily finding jobs elsewhere, which is sustaining both the tightness in the broader labor market and sturdy wage growth.

How Much Pain Is Needed?

Clearly, if profit margins narrow too much, companies will have no choice but to start purging their workforce. The Fed is apparently willing to accept some increase in joblessness; indeed, they are projecting a 1% increase in the unemployment rate over the next year to 4.6%. A rise of that magnitude has always occurred during a recession, but a 4.6% unemployment rate would still be low historically and hardly consistent with a sharp wage slowdown. Some respected economists believe that unemployment has to rise to 6% or higher to cut wage growth to 3.5%, which would translate into an additional 2.5 million unemployed workers.

However, the Fed is counting on a normalizing job market to do some of their work. One helpful assist would be to get more workers off the sidelines, lifting the labor force participation rate back to where it was prior to the pandemic. That trend is underway, particularly among prime-age women, whose participation rate has already surpassed its prepandemic peak. More supply of labor means more competition for jobs, which presumably would lower wage pressures. Still, the participation rate among prime-age men is one half percentage point below the prepandemic peak, and getting them back is critically needed to ease labor shortages.

But restoring a balance between demand and supply of labor requires changes on the demand side as well, and this is where forecasting how much joblessness would be required to ease wage pressures becomes difficult. The pessimists who think unemployment needs to rise to 6% assume that employers would have to cut millions of jobs to undercut worker bargaining power. However, The Fed believes that job cuts of that magnitude are unnecessary since the demand for workers is being amplified by the huge excess of job openings over job applicants. Just by reducing job listings, a better balance between labor supply and demand can be restored while minimizing actual job cuts. As workers see that job opportunities are less plentiful, they will temper their wage demands and give more priority over job security, particularly as economic activity slows.

A Looming But Mild Recession

We believe the Fed made the right decision by raising interest rates again as economic momentum remains strong and inflation is still stubbornly high. But the Fed makes decisions based on incoming data, which are backward-looking and do not reflect the cumulative impact of the sizeable rate hikes put into place over the past year. Households and businesses are only now adjusting to a higher rate environment, and their future behavior may change more profoundly than the Fed expects. This is the long and variable direct impact that has yet to fully play out.

More important are the indirect effects that are now surfacing because of the aggressive rate hikes over the past year. Even assuming, as we do, that the banking stress will be contained by vigilant macroprudential policies, the indirect effects may cause more pain than is currently envisioned. Even Fed chair Powell admits to uncertainty over how restrictive credit conditions may become as banks become more discriminating lenders. Against this backdrop of higher rates and reduced credit availability, the economy is likely to fall into a recession later this year. But if the Fed stops hiking rates in a timely manner and further external shocks are avoided — a big if — the downturn should be mild as the Fed succeeds in breaking something without causing a crash.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

The information contained herein is for informational purposes only and does not constitute a recommendation or advice. Any opinions are those of Legacy Private Trust Company only and represent our current analysis and judgment and are subject to change. Actual results, performance, or events may differ based on changing circumstances. No statements contained herein constitute any type of guarantee, nor are they a substitute for professional legal, tax, or other specialized advice.