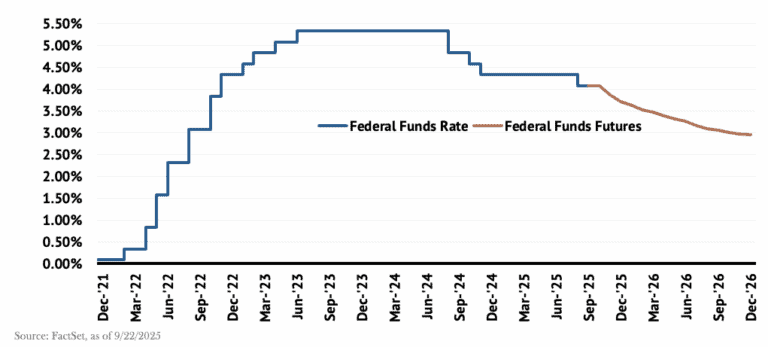

Despite a brief layover, policymakers expect the easing cycle to continue over the next year

On September 17, the Federal Open Market Committee (FOMC) cut its key interest rate by 0.25% (25 basis points or bps) to 4.00-4.25%. The widely anticipated move reflected policymakers’ view that a weakening job market poses as much, if not more, risk as elevated (I wouldn’t consider 2.9% “high”) inflation. Despite the reduction, Powell spoke hawkishly in his press conference, expressly calling this move a “risk management cut” and dismissed moves in the futures markets for a larger 50bps reduction. Traders expect two more cuts this year, followed by three in 2026, bringing the expected terminal rate to just below 3.00%.

Chart Check: Federal Reserve Resumes Cutting Cycle

Our Take

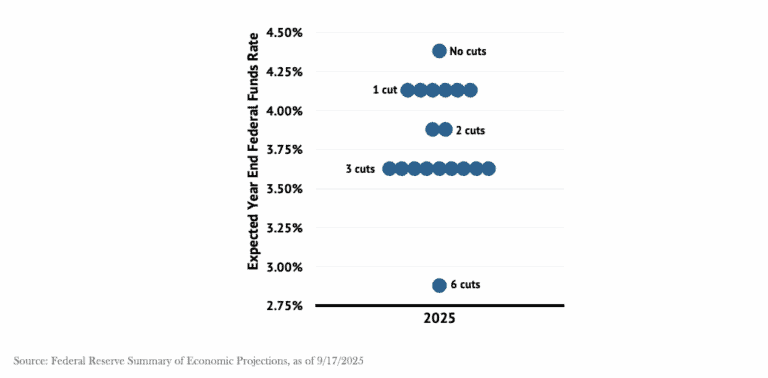

While the market correctly anticipated the Federal Reserve’s most recent decision to cut rates, the most recent FOMC announcement delivered a surprise within the FOMC’s Summary of Economic Projections. Released quarterly, this document outlines the committee’s expectations for macroeconomic variables and their expectations for future Federal Funds Rate changes, sometimes referred to as the “Dot Plot”. The most recent Dot Plot below brought some extreme disparity in appropriate interest rates for the year-end 2025.

Federal Open Market Committee Split at Margins, Consensus in the Center

The above is among the highest disparities we have ever seen from the FOMC Dot Plot. At the high-end, one member viewed the appropriate policy rate as 4.25-4.50%, the rate coming into the September meeting. In other words, that member preferred no cuts throughout 2025. On the other side of the spectrum, one member, recent appointee Stephen Miran, viewed the appropriate policy rate at less than 3.00%, totaling six cuts in 2025; in other words, two outsized 75bps cuts at every meeting until year-end. While the outliers make headlines, with two meetings to go, it seems likely that we will get two or fewer cuts from now until the end of the year.

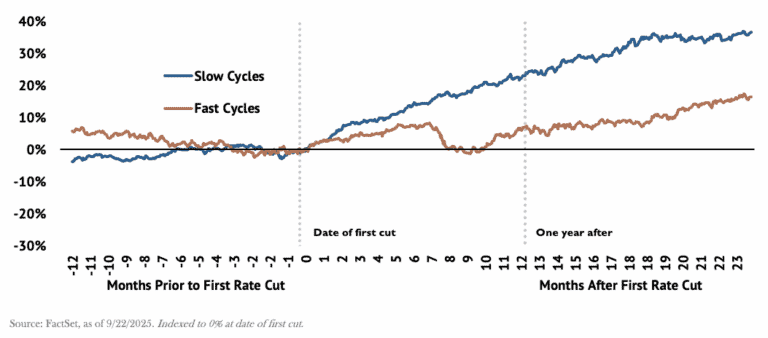

As Legacy has long preached, slow and steady wins the race when it comes to Fed easing. To help ease markets and ensure a smooth transition in the economy, the Fed prefers to move slowly. Inflation, still above the Fed’s 2% target, is another reason to proceed with caution. The committee only moves rapidly when it must, either hiking due to a rampant inflation spiral (as we saw in 2022) or cutting to spur job creation and fight off a recession (as we saw in 2020). If history is any guide, the chart below illustrates that stocks, and therefore equity holders, would gladly welcome two cuts or less this year.

S&P 500 Historically Outperforms in "Slow Cutting Cycles"

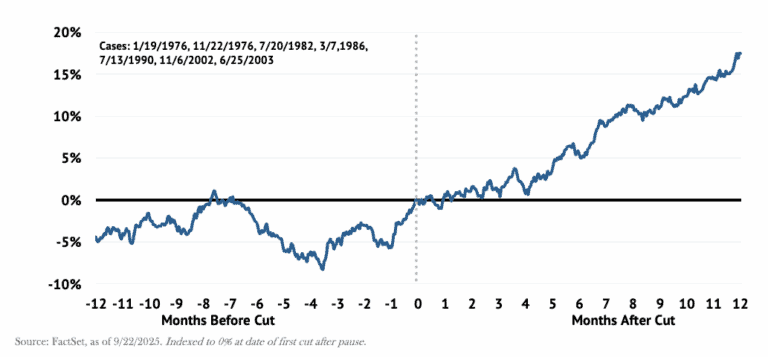

In either event, we expect this resumption of easing to be a tailwind for stocks. These events are historically rare, as the economy typically moves in cycles, and policy follows closely behind. However, the historical trend is bullish, as a revitalization of easier money makes borrowing cheaper for firms of all shapes and sizes. The chart shows the Average S&P 500 Return leading up to and following the first rate cut after a 6-month pause.

Easier Money: Another Tailwind for Equities in the Fourth Quarter and Beyond

This monthly commentary is crafted by the Investment Officers at Legacy Private Trust Company and offers an in-depth look at current economic and market trends that impact your portfolio. Subscribe to get these insights, as well in-depth markesent directly to your inbox.

As an independent firm, our advice is always driven by what is in your best interest. Every decision we make is designed to support your long-term goals and financial well-being. As a client, you will gain access to experienced professionals who know your priorities and values. These experts serve as dedicated partners who recognize the complexities of family dynamics, personal ambitions, and the ever-changing market landscape.

If you are seeking clarity, strategy, and a trusted advisor to help you navigate what comes next—our team is here to help.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.