Nvidia Crushes Earnings, Hyperscalers Tap Credit Markets, Crypto Sinks as Mr. Market Starts Asking the Tough Questions Surrounding AI Capex

The past several weeks have marked a material inflection in the market’s treatment of the AI complex. Fundamentals remain exceptionally strong, led by Nvidia’s latest results, yet price action across AI-adjacent equities has weakened, factor leadership has shifted, and the credit markets have absorbed an unprecedented wave of hyperscaler issuance with minimal spread concession. The signal is not that AI demand is slowing; it is that the market is recalibrating risk and required return as the capex cycle accelerates.

Nvidia remains the bellwether. The company posted Q3 FY2026 revenue of approximately $57 billion, up over 60% year-on-year, with data-center revenue above $50 billion. Gross margins held in the mid-70% and guidance was raised yet again. The earnings call made clear that supply of high-end GPUs remains constrained, not demand-limited, and that visibility into hyperscaler orders extends well into 2026.

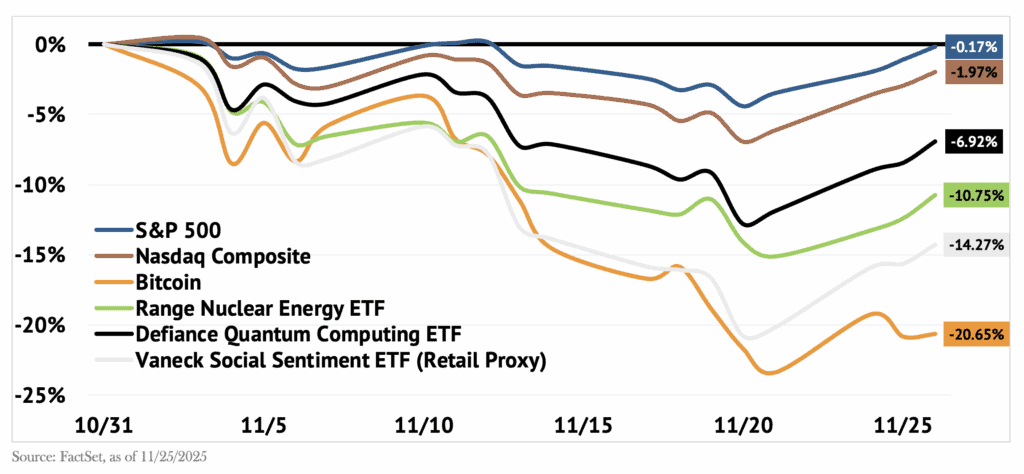

Yet the broader AI equity complex has recently come under pressure. Collectively, AI-centric stocks have lost more than $1 trillion of market value in recent weeks. Meta saw roughly $215 billion of market value erased in a single day when concerns over AI-capex and returns surfaced. Higher-for-longer interest rate rhetoric from the Fed and a more constrained discount-rate environment are increasing the cost of capital for long-dated AI pay-offs. The market is less comfortable with paying 35–40 times forward earnings for firms whose AI cash flow expectations are heavily backloaded and whose capex curves are ramping up.

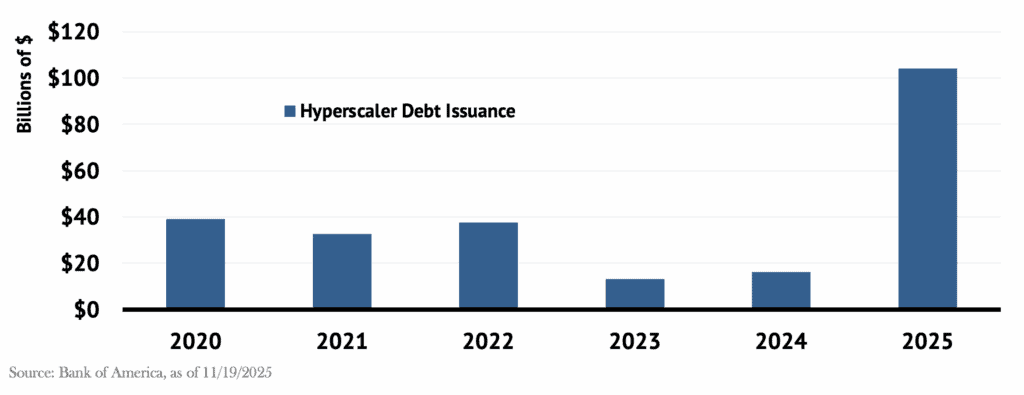

The more important development, however, has occurred in the credit markets. Hyperscalers are drawing heavily on the bond market to finance the largest private-sector capex cycle in decades. Oracle priced a deal approaching $18 billion, including a 40-year maturity — a structure that would normally require notable spread concession. Instead, order books were heavily oversubscribed, underscoring investor willingness to fund long-duration AI infrastructure. Amazon followed with approximately $15 billion of issuance, its first in several years, with proceeds directed toward data center investment, network expansion, and general corporate purposes. Meta has pre-signaled further issuance that could total close to $100 billion. Alphabet joined the party as well, coming to market for $25B. The scale of supply has pushed weekly investment-grade (IG) issuance to historically elevated levels but has not meaningfully destabilized spreads. Equity markets, however, are having to contend with the fact that AI capex may no longer be financed exclusively by cash flows of the Mag 7 companies.

Chart Check: Hyperscalers Have Issued More Than $100B in Debt Year-To-Date

This divergence — AI equities trading sideways while AI-linked credit absorbs record supply — is not contradictory. Credit investors are underwriting cash-flow durability, not multiple expansion. The hyperscaler model continues to produce substantial operating cash flow even in heavy investment years, and leverage metrics at Oracle, Amazon, Alphabet, Microsoft, and Meta remain comfortably within IG parameters. Fixed-income investors are effectively expressing confidence that the AI infrastructure cycle will generate stable returns over time, even if equity valuations remain sensitive to macro conditions and capex normalization.

For equity investors, the concern is not demand but the capital intensity required to meet it. Cloud capex guides have risen sharply across the board. The “Stargate” buildout and regionally distributed AI data center plans imply cumulative investment obligations approaching trillions of dollars across the industry. As these capex commitments scale, questions around marginal returns, utilization rates, and long-run pricing power become more important. Markets are transitioning from a narrative-defined phase to a cash-flow-verification phase.

At the same time, the broader “high-beta speculative themes” such as AI, nuclear, crypto, and quantum computing are flagging. Bitcoin has declined roughly 30% from its October 2025 peak, dragging the broader crypto market down by over $1 trillion in value in the span of just six weeks. Many of the frothiest AI-adjacent trades (neoclouds, semis, nuclear energy, and quantum computing) are looking at average drawdowns of over 50% off recent October highs.

For momentum investors, we believe the key takeaway is this: themes that once traded primarily on growth optimism are now being evaluated on execution, return on capital, timing, and cost of capital. The AI infrastructure lever is still pulling hard but the risk premium is rising. This is a notable difference from past periods. Investors were not questioning return on capital and execution during the 1990s dot-com era. Banks were not verifying income when offering real estate financing ahead of the 2008 financial crisis.

Our Take

This is not a breakdown of the AI theme. It is a repricing phase typical of early-stage industrial investment cycles. The long-term trajectory of AI compute demand, networking requirements, model complexity, and enterprise deployment remains upward-sloping. The near-term issue is the cost of capital and the valuation framework applied to a multi-year capex supercycle.

Credit markets are signaling confidence in the durability of that cycle. Equity markets are demanding proof of operating leverage beyond the infrastructure layer. Both can be true simultaneously. The next phase of the AI trade will hinge on how quickly hyperscalers convert today’s capex into incremental revenue and whether second-order beneficiaries — software, enterprise IT, and industry-specific AI deployment — begin to show earnings acceleration commensurate with the infrastructure buildout.

The wobble is therefore structural, not thematic: the market is adjusting to an AI cycle that is capital-intensive, margin-variable, and sensitive to macro duration. The fundamental engine remains intact; pricing is merely catching up to the economics.

This monthly commentary is crafted by the Investment Officers at Legacy Private Trust Company and offers an in-depth look at current economic and market trends that impact your portfolio.

As an independent firm, our advice is always driven by what is in your best interest. Every decision we make is designed to support your long-term goals and financial well-being. As a client, you will gain access to experienced professionals who know your priorities and values. These experts serve as dedicated partners who recognize the complexities of family dynamics, personal ambitions, and the ever-changing market landscape.

If you are seeking clarity, strategy, and a trusted advisor to help you navigate what comes next—our team is here to help.

If you are a Legacy client and have questions, please do not hesitate to contact your Legacy advisor. If you are not a Legacy client and are interested in learning more about our approach to personalized wealth management, please contact us at 920.967.5020 or connect@lptrust.com.

This newsletter is provided for informational purposes only.

It is not intended as legal, accounting, or financial planning advice.